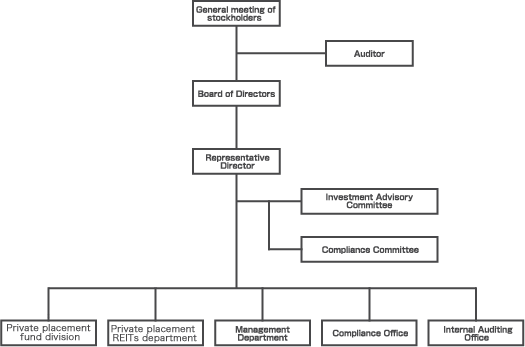

Company Overview

Company Overview

- Company name

- A.P. Asset Management Co., Ltd.

- Address

- 2-3-2 Marunouchi, Chiyoda-ku, Tōkyō Yuusen Building 3F

- Established

- October 1974

- Capital stock

- 100 million yen

- Description of business

- Asset Management

Real estate Specified joint Enterprise

Intermediation of marketable securities, handling of private placement

Intermediation involving the sale of real estate trust beneficiary rights

- Executives, etc.

- Representative Director and Chairperson Yasuo Nishioka

Representative Director and President Katsumi Shimada

Director Munehiro Mouri

Auditor Shingo Nishimura

- Licenses, etc.

- Financial Instruments Business (Investment Management Business,investment advice,

agency, type 2 financial instruments business)-Director-General of the Kanto Finance Bureau (Financial Instruments) No. 2785

Real estate specified joint Enterprise - Commissioner of Financial Services Agency, Minister of Land, Infrastructure, and Transport No. 83

Discretionary Trade License: Minister of Land, Infrastructure, Transport and Tourism, Approval No. 129

Real Estate Agent - Tokyo Governor (2) No. 93024

- Affiliated organizations

- General Incorporated Association, The Investment Trusts Association, Japan

Japan Investment Advisers Association

Type 2 Financial Instruments Firms Association

The Association for Real Estate Securitization, Japan

All Japan Real Estate Association

- TEL

- +81(0)3-6257-3022

- FAX

- +81(0)3-6206-3232

History

- October 1974 Established

- Development

- 2011

- Acquires Real Estate Agent License

Acquires Real Estate Specified Joint Enterprise (Type 1 and Type 2) License

- 2012

- Changes trade name to TSM Asset Management Co., Ltd.

Starts private placement fund and Asset Management business

Yasuo Nishioka is appointed as Representative Director

- 2014

- Financial Instruments Business (investment advice, agency) registration

Entrusted asset balance reaches 10 billion yen

- 2015

- Type 2 financial instruments business registration

- 2016

- Entrusted asset balance reaches 40 billion yen

- 2017

- Entrusted asset balance exceeds 50 billion yen

Acquires Real Estate Specified Joint Enterprise (Type 3 and Type 4) license

Changes trade name to A.P. Asset Management Co., Ltd.

- 2019

- Licensed as a discretionary trader

The balance of assets under management exceeded 100 billion yen

- 2020

- Registered as an investment management business

Executives Introduction

Group Representative Representative Yasuo Nishioka

- In 1992, Graduated Keio University, Faculty of Economics. Joined The Daiwa Bank, Ltd. (currently Resona Bank, Ltd.) in the same year. Working at domestic branches, in foreign exchange fund bill division, he engaged in trading of currency options, cash trusts utilizing derivatives, the development of investment trust commodities, etc.

- In 1995, Joined Asahi Pearl Co., Ltd. and was successively appointed as director and planning office chief and executive vice president.

Accomplished restructuring of financial affairs and personnel at this company, then was in charge of general business management such as serving as a contact point for negotiations with financial institutions, the promotion of rationalization by driving sales by cultivating new clients, etc. and integrating subsidiaries. - From 2001, worked at Sumitomo Trust Bank, Ltd. (currently Sumitomo Mitsui Trust Bank, Ltd.). In the Tokyo No. 3 sales division, corporate banking division, and real estate financial solutions division among others he was engaged in corporate financing for real estate and construction companies, creation and arrangement of non-recourse loans for domestic and overseas real estate investment funds, and other duties.

His major achievements included the arrangement of a syndicate loan of a total of 46 billion yen loan for a major Japanese real estate company (February 2006) and the arrangement of a real estate non-recourse loan of 130 billion yen for a consortium SPC headed by 7 companies including major domestic real estate companies involved in the redevelopment project in Kansai area (June 2007). - In 2007, joined SI Asset Services Corporation. At this company he supervised various consulting and asset management duties in the fields of real estate and finance, etc.

He engaged in securitization arrangement, structured finance, and asset management involving real estate consulting and real estate investment projects for companies. - From 2009 (to present), appointed as Representative Director of Asahi Pearl Co., Ltd. (currently A.P. Products Co., Ltd.).

- In 2012, appointed as Representative Director of TSM Asset Management Co., Ltd. (currently A.P. Asset Management Co., Ltd.).

Representative Director Katsumi Shimada

- In 1988, Graduated Keio University, Faculty of Economics. Joined Recruit Cosmos CO., LTD. (currently Cosmos Initia CO., LTD.) in the same year.

- In 1990, participated in the founding of Princess Square Co., Ltd., a real estate company specializing in the apartment house business. Supervised the sales department as director in charge of sales and contributed to building the foundation of the company.

He was also engaged in the real estate business personally, intermediating more than 300 segmented apartment houses and 10 commercial buildings. - In 2014, appointed as director of TSM Asset Management Co., Ltd.

(currently A.P. Asset Management Co., Ltd.).

In addition to principal investments, he succeeded in more than 20 development project utilizing development type SPCs.

He has achieved many successes in investments in assets with strong social significance including the development of licensed nurseries in addition to being in charge of the development of the "La Perla" series in the apartment house business, which succeeded in both design and practicality.

Director Munehiro Mouri

- In 1981, joined Tokai Seimitsu Co., Ltd. (currently Tokai Co., Ltd.).

- In 1989, joined Aizawa Securities Co., Ltd. Subsequently worked on the financial product development, marketing planning and administration of investment trusts, etc. at Rothschild Investment Trust Investment Advisory Co., Ltd., Credit Suisse Investment Trust Co., Ltd., and AMP Henderson Global Investors. At Henderson Global Investors he was in charge of creating the first global REIT fund in Japan.

- In 2008, established Brown Field Advisors Co., Ltd.. Appointed as director.

Achieved commercialization of contaminated soil sites restoration project (contaminated soil site restoration fluidization project) utilizing a fund scheme. - In 2012, joined TSM Asset Management Co., Ltd. (currently A.P. Asset Management Co., Ltd.). Appointed as director.

Promoted project creation arrangement utilizing equity of overseas investors.

Major achievements include the Kumamoto prefecture Mega-Solar, exceeding 12 billion yen in total project cost, as well as the arrangement of Mega-Solar development projects in Hokkaido and Fukushima prefectures totaling more than 24 billion yen.

Greeting

We at A.P. Asset Management Co., Ltd. provide advice and consulting services regarding investment in real estate, renewable energy generation, etc. and provide Asset Management support for clients as part of the "A.P. Capital Group" based on the management philosophy of "promoting business based on trust" in cooperation with "A.P. Realty Co., Ltd.", which is also a part of the group.

Especially at our company, through our high quality Asset Management, we provide our customers with maximized investment returns with our understanding of the characteristics of investment assets and market trends, searching for all possible routes to increase value while striving to improve investment value by reviewing leasing strategies, as well as renewing and rebuilding the assets.

Furthermore, in deciding on exit strategies, in order to maximize investment returns we ascertain trends in the real estate market and financial environment to propose the best sales and refinancing based on suitable forecasts.

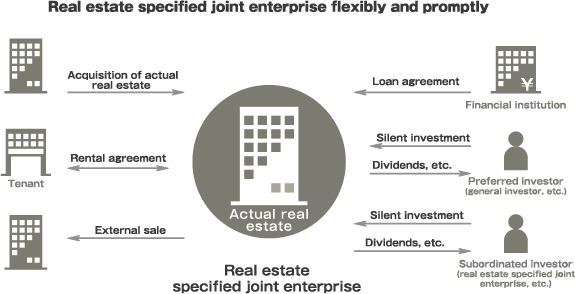

At our company, as a part of our Asset Management business expansion we acquired licenses as a Type 3 Operator and Type 4 Operator in accordance with the Revised Act on Real Estate Specified Joint Enterprise which was enacted in December of 2013.

For regional projects and small-scale properties which were difficult to handle via the TMK scheme and GK-TK scheme using beneficiary rights, we believe this will make it possible to respond to them flexibly and speedily while also leading to the design and development of investment products filled with originality.

Furthermore, our company sees SPE management business involving fluidization and securitization as a core value, and we also collaborate with "Tokyo SPC Management Group" which provides one-stop support for taxation and financial strategies.

Utilizing this taxation and accounting know-how, our company's staff possessing diverse fields of specialization centered around finance and real estate are active every day to provide optimum solutions to our customers.

Our company hopes to continue our pursuit of the best services for our clients while contributing to society.

A.P. Asset Management Co., Ltd.

Representative Director

Yasuo Nishioka

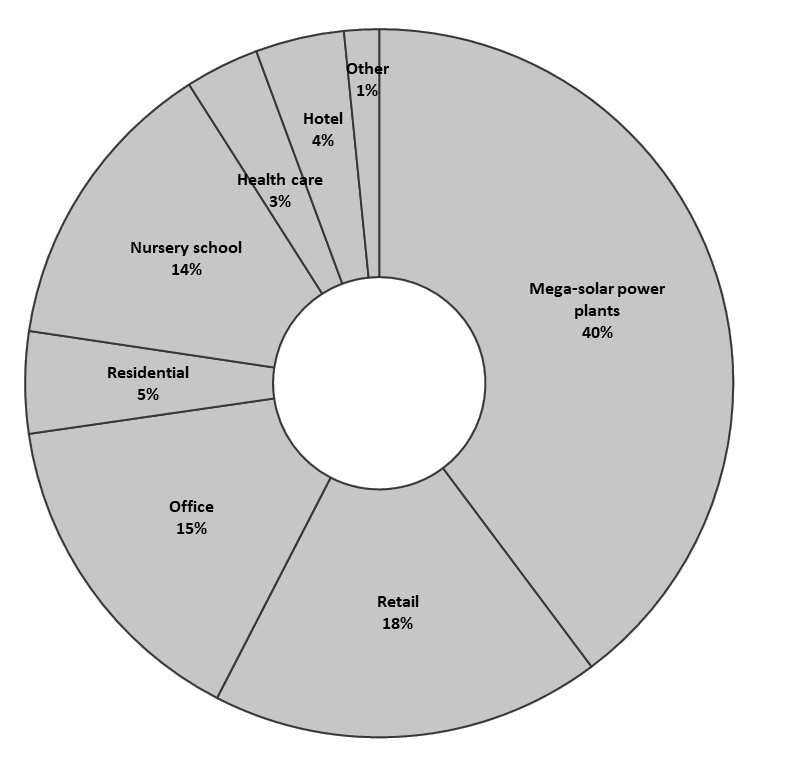

operational experience

AUM

139,970 million yen (as of June 2021)

| Mega-solar power plants | 55,671 |

|---|---|

| Retail | 24,916 |

| Office | 21,190 |

| Residential | 6,503 |

| Nursery school | 19,059 |

| Health care | 4,728 |

| Hotel | 5,666 |

| Other | 2,233 |

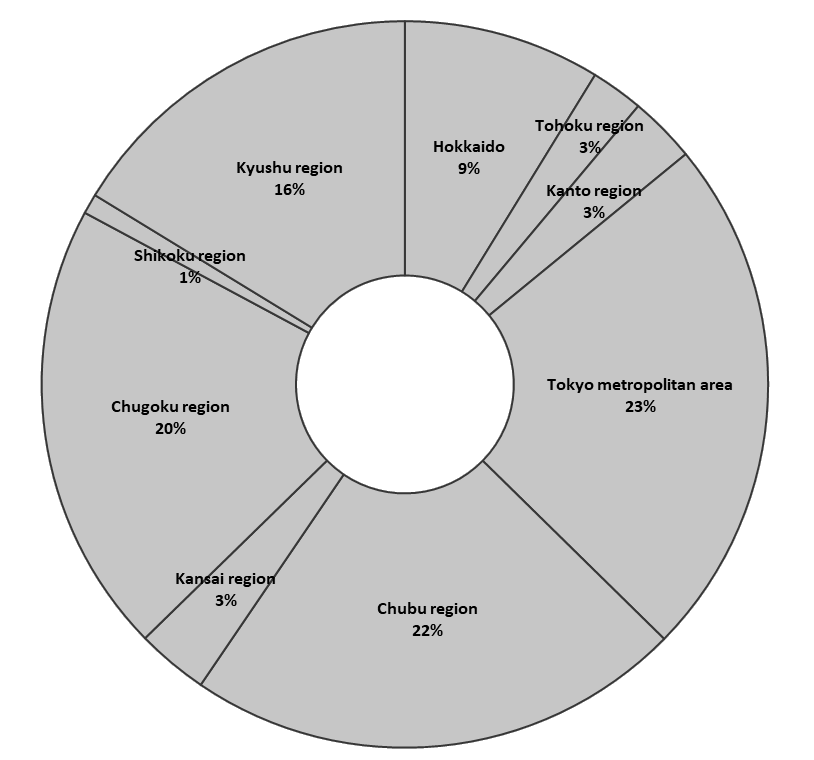

| Hokkaido | 12,273 |

|---|---|

| Tohoku region | 3,267 |

| Kanto region | 4,151 |

| Tokyo metropolitan area | 32,588 |

| Chubu region | 31,005 |

| Kansai region | 4,460 |

| Chugoku region | 28,198 |

| Shikoku region | 1,243 |

| Kyushu region | 22,780 |

operational case study

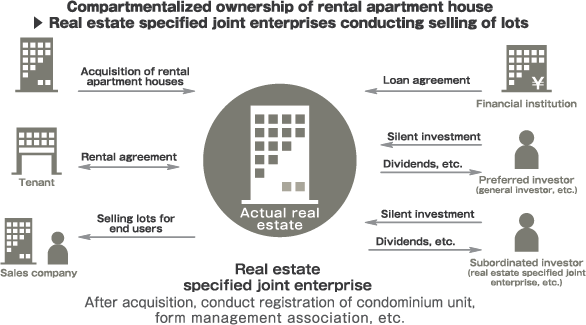

Specified Real Estate Cooperative

Property acquisition・operation・sale

In general real estate securitization schemes, “trust beneficiary right" rather than "real estate" is a target asset. Therefore, it is necessary to select a real estate fulfilling the trust bank's consignment requirement after assuming at least one month as a required period of time and burdening the DD cost such as trust setting cost, and real estate appraisal cost etc. On the other hand, in the Specified Real Estate Cooperative Business, we are able to swiftly proceed with acquisition, operation and sale of real estate in the same sense of speed as real estate transactions.

Segmentation of rental rooms and room sales business

While rental condominiums owned by profitable investors and funds as revenue real estate meet the end of the investment period, some property with selling specifications or any other equivalent specification or those that can withstand re-distribution to individuals by implementing renovation certainly exist. We are precisely aiming to purchase these at profitable real estate prices, make registrations for them separately and resell them for individuals to enjoy the gap between the capital gain and the end market price. This business is not only a case for one condominium project; it is also possible to sell even one apartment unit of a condominium in an extreme case. Attempting to carry out this project with the traditional fluidized method (TMK, GK-TK + trust beneficiary right), there are many bottlenecks in dealing with asset fluidized plans and trust beneficiary rights, and the work becomes extremely troublesome as a typical tendency. In the case of Specified Real Estate Cooperative Business, this scheme is suitable because of these troubles being eliminated.

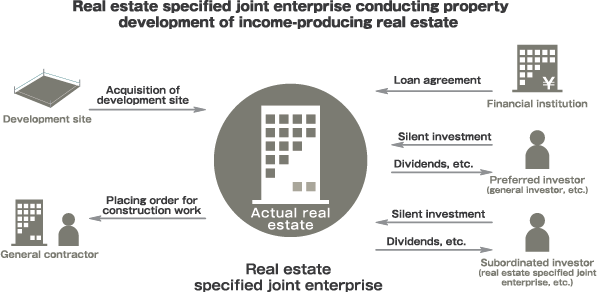

Property development

For relatively small single-tenant commercial facilities such as convenience stores and drugstores, long-term lease contracts can be executed by excellent business people so that general investors also like individual investors and asset management companies have potential holding needs from the viewpoint of long-term stable operation. However, some suppliers for investment opportunities to meet the end of the lease period and to purchase newly-built properties for rental are limited currently due to few suppliers. In addition, development risk is also limited because it is a relatively short term and under the assumption of secured yields above a certain level pursuant to the lease contract agreement in advance. This development in a Specified Real Estate Cooperative Business results in the development profit in spite of its relatively low risk.

Condominium reconstruction project

While, as of December 2007, the total number of stocks in our country had reached approximately 5.28 million units, the stocks exceeding 30-year old accounted for about 630,000 units; moreover, the stock supplied before the establishment of the new earthquake resistance standards (1981) had reached approximately 1.06 million units. Therefore, the rebuilding of aging condominiums has significantly become a huge social issue. Under the present situation of only 129 condominiums (rebuilding apartments not included) having been rebuilt, the involvement of specified real estate cooperative business operators with advanced knowledge on construction, real estate, and taxes is essential to solve the associated problems: that many existing condominiums are unqualified in accordance with the Building Standard Law, undefined examinations cost, undefined rebuilding expenses and undefined individual consideration for elderly residents and low-income people In case of rich experience in actual performance of this business, we are surely aiming to work on the development projects for the withdrawn site of large stores, site of relocation / withdrawal of factory, and abandoned farming grounds, exploiting those obtained successful know-how.

Otherwise

Soil Contaminated Land Purchasing Business

By purchasing lands in the presence of soil and groundwater pollution, we are planning to cut off the various risk burdens owned by the originator at the time of trading, consult with a purification consulting firm with state-of-the-art technology and conduct construction work as appropriate measures during the project period within the scheme and sell it to the exit user. In addition, by eliminating the cost overrun risk by making full use of insurance etc., and by preceding the execution of sales contract with a final customer, we are definitely aiming to provide a mechanism to be able for him or her to obtain appropriate return on investment while minimizing investment risk.

Investment Case serving investment projects with unsuitable scale for SPC scheme

With conventional fluidized schemes (GK-TK, TMK), we were unable to bear initial cost such as scheme building-up cost and trust fee, unless we had a certain scale of business. However, in the specified real estate corporative business, it is possible to dramatically reduce initial costs and to expand the base of affordable projects. Furthermore, it is also possible to cope with speedy property settlement that was unavailable in a conventional fluidized scheme.

Increasing Value for targeted unavailable individual investors

Focused on highly-fluidized profitable properties with an exit price of about 300 to 500 million yen and paying attentions to value increasing potentiality, we are clearly aiming to acquire properties for individual end investors as exit targets.

Medium-sized real estate company settlement solutions and base function of cooperation among real estate companies

As a solution for the settlement of the mid-sized real estate company, provisional holder function of selling real estate can also be provided. If it is a flow of [purchase at a price lower than the end price ⇒ redemption after a certain period of time ⇒ end sales], the safety in business is also going to further improve. Moreover, it also forms a useful base function when multiple real estate companies promote selected projects cooperatively.

- These projects indicated above are just the examples utilizing the Real Estate Specific Collaborative Business Law License; we are fully preparing to execute new Specified Real Estate Cooperative Business in response to any changes in the needs of investors and the market environment in the future.

Privacy Policy (Personal Information Protection Policy)

When handling personal information and specific personal information (hereinafter collectively referred to as “Personal Information”), A.P. Asset Management Co., Ltd. (hereinafter referred to as “the Company”) shall endeavor to properly handle, manage, and protect Personal Information as it abides by with the relevant laws, guidelines, etc., and shall establish and comply with the following privacy policy (hereinafter referred to as “this Policy”).

1. Basic policy on the handling of Personal Information

The Company shall comply with the following basic policy based on the understanding that Personal Information is an important information asset and that the Company does not have only the legal obligation but also the social responsibility to properly acquire, manage, and use the Personal Information it has acquired to the extent necessary for its business.

-

(1)The Company shall acquire Personal Information by proper and legal means to the extent necessary to achieve the purpose of use specified by the Company. The Company will not acquire Personal Information by falsehood, by other illegal means, or in any manner that would unfairly infringe on the interests of the person concerned. Additionally, the Company will not acquire special care-required Personal Information without the consent of the person concerned, except as provided by laws.

-

(2)The Company shall always keep and manage the personal data it has acquired in an accurate and up-to-date state, and shall endeavor to delete the personal data concerned without delay when it is no longer necessary. Additionally, to prevent in advance unauthorized access to, leakage of, loss of, damage to, or falsification of personal data, the Company will provide thorough employee training and take necessary and proper measures to safely manage personal data.

-

(3)The Company will not handle Personal Information it has acquired beyond the extent necessary to achieve the purposes specified by the Company, except in cases when the Company has obtained prior consent from the person concerned or in exceptional cases permitted by laws and the like.

-

(4)If the Company receives a complaint or the like about the handling of Personal Information, the Company will endeavor to respond properly and promptly within a reasonable period. For inquiries regarding the handling of Personal Information, please contact the relevant parties using the details stated in section 8.

2. Purpose of use of Personal Information

The Company will handle Personal Information only to the extent necessary to achieve the purpose of use, except in cases where the Company has obtained prior consent from the person concerned or in exceptional cases permitted by laws and the like. Additionally, when acquiring directly from the person concerned Personal Information stated in a contract or other document, the Company will clearly state the purpose of use to the person concerned in advance. The Company may, however, omit the specification of the purpose of use if it is permitted by laws, and the purpose of the use is clear from the circumstances of acquisition, and the like.

3. Provision of personal data to a third party

The Company does not provide personal data it has acquired to third parties, except in the following cases:

-

①Consent of the person concerned has been obtained

-

②When required by laws③When it is needed in order to protect the life, body, or asset of a person and it is difficult to obtain consent from the person concerned.④When it is particularly necessary for the improvement of public health or to promote the sound growth of children, and it is difficult to obtain consent from the person concerned.⑤When it is necessary to cooperate with a government organization or a local government, or a person entrusted by such an organization in executing the affairs prescribed by laws, and obtaining the consent of the person concerned is likely to impede the execution of the said affairs.

4. Acquisition of Sensitive Information and the like

Except as provided in the Guidelines for Protection of Personal Information in the Finance Sector, the Company will not acquire, use, or provide to a third party in the finance sector any special care-required Personal Information or information related to (excluding information that is disclosed by the person concerned, a government organization, a local government, or a person listed in the Act on the Protection of Personal Information or the Ordinance for Enforcement of the Act on the Protection of Personal Information, or distinct exterior information that is obtained by observing or photographing the person concerned) labor union membership, birth, legal domicile, health and medical care, or sex life (excluding special care-required Personal Information).

5. Supervision of outsourcing and contractors

When the Company outsources all or part of the handling of personal data, the Company will take proper measures to protect personal data as per laws and the like, and supervise the outsourced party as necessary and appropriate to ensure the outsourced personal data is managed safely.

6. Procedures of the disclosure and the like of possessed personal data

If the Company receives, through a designated request form accompanied by a document that verifies the identity of the person concerned, a request for the disclosure, correction, addition, deletion, suspension of use, erasure, or suspension of provision to a third party (hereinafter referred to as “disclose and the like”), or a request for the notification of the purpose of use of possessed personal data as per the Act on the Protection of Personal Information, the Company will respond appropriately without delay as per laws and the like, as soon as the request is confirmed to have been made by the person concerned or the legitimate representative. Possessed personal data shall be disclosed in writing or by any other method to which the person concerned consents. However, in certain cases, such as when there is a risk of harming the life, body, assets, or other rights and interests of the person concerned or a third party, the Company may not be able to respond to the request for disclosure and the like or the request for notification of the purpose of use. In such cases, the Company will notify the person or the representative of the reason without delay. For more information on the procedures, please contact the relevant parties using the details stated in section 8. Additionally, customers may be asked to pay a fixed fee for the disclosure of personal data.

7. Continuous improvement

The contents of this Policy shall be applied from its date of publication on this website. The Company will continuously review the contents of this Policy, revise it appropriately as necessary, and endeavor to improve the management of Personal Information and the like. If the contents of this Policy are revised, it will also be immediately posted on the Company’s website.

8. Contacts for inquiries

For inquiries regarding the handling of Personal Information, requests for disclosure and the like of possessed personal data, requests for notification of the purpose of use, and complaints, please contact the relevant parties at the following details.

【Inquiries about Personal Information】

Please contact the Company at the following for corrections, additions, or deletion of Personal Information.

Company name: Compliance Office, A.P. Asset Management Co., Ltd.

Address: 2-3-2 Marunouchi 2-Chome, Chiyoda Ward, Tokyo 100-0005, Japan

TEL: 03-6257-3022

Office hours: 9:30 a.m. to 5:30 p.m. (excluding Saturdays, Sundays, and public holidays)【Certified Personal Information Protection Organization】

The Company is a member of the following certified personal information protection organizations. All of the following organizations accept complaints and consultations regarding the handling of Personal Information by their member companies.

General Incorporated Association, The Investment Trusts Association, Japan, Investor Consultation Office

TEL: 03-5614-8440

Office hours: Monday to Friday (excluding public holidays) 9:00 a.m. to 5:00 p.m.

General Incorporated Association, Japan Investment Advisers Association, Executive Consultation Office for Complaints (in charge of Personal Information)

TEL: 03-3663-0505

Office hours: Monday to Friday (excluding public holidays) 9:00 a.m. to 5:00 p.m.

Revised: April 27, 2020

Solicitation Policy for the Sale of Financial Products, Etc.

Our company's Basic Stance Regarding Solicitation to Customers

We endeavor to conduct appropriate solicitation and provide explanations with a comprehensive understanding of our customers' knowledge, investment experience, current assets, and investment purpose (purpose of executing agreements for the sale of the financial products in question).

Methods and Hours of Solicitation to Customers

Our company endeavors to take sufficient care regarding times, places, and methods of solicitation to customers to avoid inconveniencing them.

We endeavor to solicit to customers at times and places and with methods that are convenient to our customers.

Ensuring Reasonable Solicitation

We endeavor to provide accurate information to avoid causing misunderstanding on the part of the customer.

We work to ensure that customers correctly understand the important points of the "Law Regarding the Sale of Financial Products, Etc.".

In order for the customer to make investment decisions that are appropriate for them, we endeavor to provide sufficient and accurate explanations regarding the product details, risks, etc.

When soliciting and providing information, we always consider the benefit of the customer and comply with all related laws and regulations.

In order to conduct reasonable solicitation, we take serious measures toward creating in-house systems as well as education and training.

Display of Advertisements, etc. in Accordance with the Financial Instruments and Exchange Act

The products this company deals in or the services this company provides are extensive and diverse, and regarding related fees, remuneration, and various expenses (hereinafter referred to as "fees, etc.") we must individually determine the necessary types, amounts, etc. of fees, etc. after taking into consideration various circumstances such as the class of product or service provided by the company and the contract period, and therefore we are unable to display the amounts or calculation methods of these fees, etc. in advance. Regarding fees, etc. for individual products or services by this company, please check with the responsible staff at the company.

Financial products handled by this company such as "real estate trust beneficiary rights" and "silent investment interests" are subject to loss of assets due to fluctuations in real estate prices, rent, etc. as well as fluctuations in interest rates, etc. Furthermore, there is no guarantee of principal or profits. The risk of the value of marketable securities invested in cutting into the investment principal is borne by the customer. Regarding the risks associated with individual products, please examine and confirm the contract details which this company will send you in writing in advance.

A.P. Asset Management Co., Ltd.

Financial Instruments Business

Director-General of the Kanto Finance Bureau (Financial Instruments) No. 2785

Type 2 Financial Instruments Business, investment advice, agency

Member of the Japan Investment Advisers Association

Member of the Type 2 Financial Instruments Firms Association,

Cutoff date for the professional investors system

Regarding the "cutoff date" for the professional investors system under the Financial Instruments and Exchange Act, this Company makes the following proclamation in accordance with the provisions of Article 34-3 Clause 2 and Article 34-4 Clause 6 of the Financial Instruments and Exchange Act.

According to the Financial Instruments and Exchange Act, customers are classified as "professional investors" and "general investors", but there are cases where a customer can transition from a "professional investor" to a "general investor" or from a "general investor" to a "professional investor" via an application by the customer through designated procedures.

The "cutoff date" for transitioning from a general investor to a professional investor is as follows.

Cutoff date: The first August 31th which comes after the transition

Once the "cutoff date" has passed, customers who have transitioned from general investor to professional investor will return to the classification of general investor. If the customer wishes to continue the transition of investor classification, the customer is asked to please complete the renewal procedures before the cutoff date.

Measures for Processing Complains and Resolving Disputes

this Company's Measures for Processing Complaints

For complaints, etc. regarding this Company's business, please inquire with the following contact point.

Compliance office

Phone number:03-6257-3022(Reception hours: Weekdays 10:00~17:00)

Measures for Processing Complains and Resolving Disputes Relating to the Financial Instruments Business

In addition to resolving complaints through the aforementioned in-house contact point, we also work to process complaints and resolve disputes through the organizations listed below. To utilize these organizations, please contact them as shown below

Financial Instruments Mediation Assistance Center

2-1-13 Nihonbashikayabachō, Chūō-ku, Tōkyō 103-0025

0120-64-5005(toll‐free call)

Reception hours:Monday~Friday 9:00-17:00

(Excluding national holidays including compensatory holidays as well as December 31 through January 3)

Basic Policy for Responding to Anti-social Forces

Basic Policy for Responding to Anti-social Forces

This company has established a basic policy to prevent relationships with anti-social forces as follows, and will endeavor to ensure the adequacy and safety of our business.

- This company interacts with anti-social forces as organizations.

- This company will respond to anti-social forces in cooperation with specialized external organizations such as the police, anti-crime syndicate centers, and lawyers.

- This company will refuse any and all relationships which include dealings with anti-social forces.

- When anti-social forces make unlawful demands, etc., we will respond legally from both the civil and criminal sides.

- There are absolutely no secret dealings with or funding from anti-social forces.

Policy on customer-centric business operations

The Company has adopted all seven principles of the Principles of Customer-Centric Business Operations, published by the Financial Services Agency on March 30, 2017, and has established the following policies on customer-centric business operations.

1. Formulation and publication of policies on customer-centric business operations

-

1.The Company shall formulate and publish the policies that have been taken to achieve customer-centric business operations and shall regularly publish the policy status on its website and the like.

-

2.The Company shall regularly review these policies in order to achieve better business operations.

2. The pursuit of the best interests of customers

-

1.As a member of the A.P. Capital Group, based on the management philosophy of “driving the business forward with trust as the foundation”, the Company shall develop a business that is highly particular about the quality of services and products and continue its efforts to maximize the clients’ investment returns through high-quality asset management services.

-

2.The Company shall conduct business with a strong sense of ethics, integrity, and fairness, as well as in compliance with laws. Furthermore, it shall endeavor to establish a corporate culture of customer-centric business operations.

3. Appropriate management of conflicts of interest

-

1.The Company shall accurately grasp the possibility of conflicts of interest with customers and appropriately manage them as per laws, internal rules, etc.

-

2.The Company shall establish decision-making procedures, standards, etc. to prevent customers’ interests from being harmed during transactions that may have a conflict of interest, as per internal rules.

4. Clarification of fees and the like

- Taking into account relevant laws and the like, the Company shall set the amount of remuneration or the method of calculating the amount of remuneration after consulting with every customer, based on the type and attributes of the target of trade, trade practices in the market, etc.

5. Provision of important information in an easy-to-understand manner

-

1.The Company shall provide information tailored to the customers and the characteristics of the products after it considers the customer’s trading experience and financial knowledge.

-

2.For private investment corporations, the Company will make appropriate disclosures on the website and other platforms that are exclusive to the investor who is from the investment corporation, as per laws, internal rules, etc.

6. Provision of services suitable to customers

- To strive for the best interests of customers, the Company shall understand the purposes, needs, etc. of the customers’ trade, and endeavor to provide the customers with suitable services.

7. Appropriate motivational framework and the like for employees

- By conducting regular and ongoing compliance training and the like for all executives, as a trader in financial instruments, the Company shall strive to be thorough with the compliance, maintain and improve the governance system, and continue to promote the above policies 2 to 6.

The status related to this policy

Established: April 27, 2020

Inquiries・Link

A.P. Asset Management Co., Ltd.

2-3-2 Marunouchi, Chiyoda-ku, Tōkyō Yusen Building

TEL :03-6257-3022

FAX :03-6206-3232